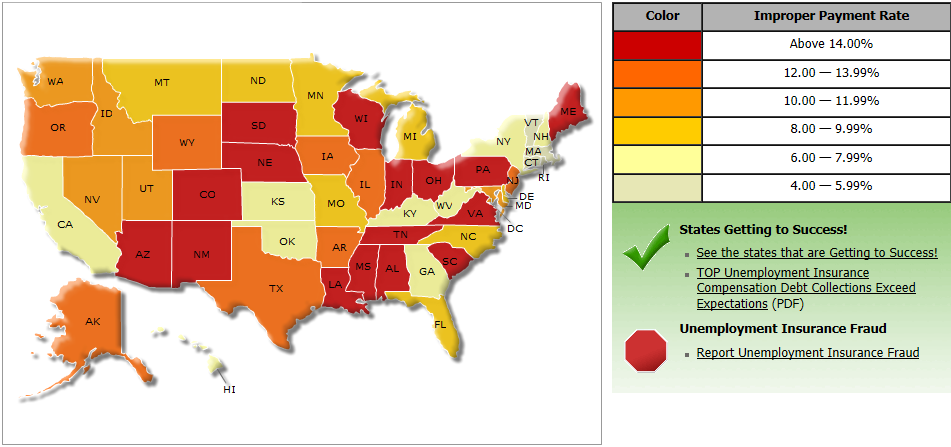

Fraudulent payment of unemployment insurance benefits is a nationwide problem, accounting for as much as 14% of total payments in some states. The chart shows that most states are paying anywhere from 8%-12% extra in claims. When you consider that the payment period for many claims has been extended during the Obama Administration, that’s a lot of wasted dollars!

Most employers give up on fighting unemployment claims because they find it very difficult to win them. Lawyers are too expensive to hire, and employers have too little expertise — that’s why unemployment benefits consultants have set up a niche practice of defending employers.

In general, unemployment insurance is available to employees who lose their jobs “through no fault of their own,” as determined by state law. Although federal law sets some guidelines, each state administers its own unemployment insurance program. All but three states fund their programs from a tax imposed solely on employers. Employees generally receive payments for maximum of 26 weeks in most states, unless the period is extended in times of high unemployment. Employees are required to look for other work and prohibited from receiving benefits once they obtain it (this is where much of the fraud comes in).

In most states, an employee fired for misconduct can be denied unemployment benefits. The question is, how do you define “misconduct”? Essentially, it has to be a willful act, such as insubordination, excessive absenteeism, insubordination, dishonesty, or drug or alcohol use that damages the company in some way. However, fired employees who simply don’t do their job properly or in a timely fashion will be eligible for unemployment benefits.

For example, the California Unemployment Code § 1256 states:

“An individual is disqualified from unemployment compensation benefits if … he or she has been discharged for misconduct connected with his or her most recent work.” Misconduct is limited to conduct evidencing such willful or wanton disregard of an employer’s interests as is found in deliberate violations or disregard of standards of behavior, which the employer has the right to expect of his employee, or in carelessness or negligence of such degree or recurrence as to manifest equal culpability wrongful intention or evil design, or to show an intentional and substantial disregard of the employer’s interest or the employee’s duties and obligations to his employer. On the other hand, mere inefficiency or unsatisfactory conduct, failure in good performance as the result of inability or incapacity, inadvertencies or ordinary negligence in isolated instances, or good faith errors in judgment or discretion are not deemed “misconduct” within the meaning of the statute.”

If you intend to contest an unemployment claim, make sure that you have documentary support (such as a statement under oath signed by the claimant’s manager or fellow employees, a photo, or a warning notice). Of course, fighting a claim will up the ante with the employee, who might respond by contacting an attorney and filing additional claims. Always something to consider!

Finally, many companies suffer from high unemployment claims because they have unnecessarily high turnover rates. If this is the case, ask what you can do to prevent unwanted turnover. You should also question why you hired the terminated employees in the first place.