That Works has an extensive report and checklist about what’s known as the “contingent workforce.” This includes temporary employees, leased employees, and more. Here are some questions to consider in these relationships:

That Works has an extensive report and checklist about what’s known as the “contingent workforce.” This includes temporary employees, leased employees, and more. Here are some questions to consider in these relationships:

Who is responsible for what? — As with any arrangement, it’s important to study the contract. For example, if an employee isn’t working out, who should be responsible for firing them? Consider every aspect of managing personnel from hiring through performance management and retention to termination.

How much are you paying to outsource various HR functions? — Whether you’re outsourcing because you don’t have the time, expertise, or desire to do the job in house, you’ll have to pay for someone else to do it for you. What’s the competitive rate? What about the provider’s experience and results? Do your homework and interview at least a couple of providers and their clients before you choose one.

What is the provider’s hiring process? — They should be able to show it to you in writing. If they can’t, pick someone else. Make sure that the provider does proper skill testing, character assessments, background checks, extensive interviews, immigration checks and pre-hire physicals.

What references can the provider offer? — Don’t just ask for references, get the names of companies who have used the vendor during the past year. See if the vendor is willing to share this information and allow you to interview those companies. Ask “What will these companies tell us?” Then do Google research to see what comments you can find online. What’s the knowledge on board at the vendor? — How long has the person who does the hiring and staffing been doing their job? What are their credentials? Is there expertise on board to help you with any compliance concerns?

Does the agent carry the right insurance? — Depending on whose payroll is involved, the law requires employers to provide Workers Compensation benefits, as well as withholding unemployment and Social Security taxes, and more. If the temp or leasing agency treats their workers as independent contractors you could end up being in a heap of trouble.

Does the agency provide employees benefits? — Remember, if a worker walks and talks like your employee, they’re probably going to be considered your employee, whether they’re a sole employee or in a joint employer relationship. If an employee receives no benefits from the provider, you can easily face a hefty benefits claim down the road.

What about union activities? — To what extent has the agency been faced with unionization efforts? Your temporary workforce might be considered part of an existing bargaining unit and thus covered by your union contract. HR That Works members should view the extensive Contingent Worker Report and Checklist.

Winter weather often includes snow and ice, two hazards that can create dangerous conditions on your commercial property. Prepare to keep your employees and customers safe when you prep your property for winter snow and ice removal.

Winter weather often includes snow and ice, two hazards that can create dangerous conditions on your commercial property. Prepare to keep your employees and customers safe when you prep your property for winter snow and ice removal. Security should be one of your company’s top priorities as you protect your merchandise, equipment and technology. Consider 10 security tips that reduce your risk of break-ins.

Security should be one of your company’s top priorities as you protect your merchandise, equipment and technology. Consider 10 security tips that reduce your risk of break-ins. Nuclear energy is the future of our energy needs both domestically and around the world. This atomic energy has been proven to be much more cost-effective over conventional methods of attaining energy. Essentially, nuclear power plants can cover more customers using less energy and it is considered environment-friendly.

Nuclear energy is the future of our energy needs both domestically and around the world. This atomic energy has been proven to be much more cost-effective over conventional methods of attaining energy. Essentially, nuclear power plants can cover more customers using less energy and it is considered environment-friendly. In your small business, you may use a variety of equipment, including tools, vehicles, excavators, computers, and landscaping tools. You can lease or buy this equipment. Because both options include risks, compare both options.

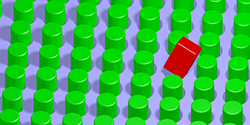

In your small business, you may use a variety of equipment, including tools, vehicles, excavators, computers, and landscaping tools. You can lease or buy this equipment. Because both options include risks, compare both options. I’m a big fan of using character assessment tools — and one of my favorites is www.zeroriskhr.com. My team and I are currently using their post-employment program to help improve our communication and make me a more effective boss. The folks at ZeroRisk reminded me that the employer’s goal is to match skills and natural abilities with job function. As the saying goes, “Put square pegs in square holes!”

I’m a big fan of using character assessment tools — and one of my favorites is www.zeroriskhr.com. My team and I are currently using their post-employment program to help improve our communication and make me a more effective boss. The folks at ZeroRisk reminded me that the employer’s goal is to match skills and natural abilities with job function. As the saying goes, “Put square pegs in square holes!” As a small business owner, you accept credit cards because it’s convenient for your customers and a smart business decision. You could be overpaying for your credit card processing privilege, though, which puts your business’s financial security at risk. Every month, evaluate your credit card processing statements and take six steps to avoid overpayment.

As a small business owner, you accept credit cards because it’s convenient for your customers and a smart business decision. You could be overpaying for your credit card processing privilege, though, which puts your business’s financial security at risk. Every month, evaluate your credit card processing statements and take six steps to avoid overpayment. Corrosives are solid or liquid substances that exact extreme caution when handling. They are usually either an acid, such as nitric acid, sulfuric acid, chromic acid, hydrochloric acid, hydrofluoric acid, or acetic acid, or a base, such as ammonium hydroxide, sodium hydroxide, or potassium hydroxide. Anyone that has ever seen the effects that corrosives have on metal or other strong materials can easily imagine the damage that a corrosive would do to the delicate human skin.

Corrosives are solid or liquid substances that exact extreme caution when handling. They are usually either an acid, such as nitric acid, sulfuric acid, chromic acid, hydrochloric acid, hydrofluoric acid, or acetic acid, or a base, such as ammonium hydroxide, sodium hydroxide, or potassium hydroxide. Anyone that has ever seen the effects that corrosives have on metal or other strong materials can easily imagine the damage that a corrosive would do to the delicate human skin. Your small business faces numerous risks every day. To protect your business, you need seven different insurance policies. Learn more about what they are and how they help you.

Your small business faces numerous risks every day. To protect your business, you need seven different insurance policies. Learn more about what they are and how they help you. In the recent case of In Re: the Compensation of Mary S. Sandberg, an Oregon court overruled the Workers Comp Board and held that a JC Penney decorator, who was allowed to work from home, was covered by her Workers Comp policy when she tripped over her dog unloading a van.

In the recent case of In Re: the Compensation of Mary S. Sandberg, an Oregon court overruled the Workers Comp Board and held that a JC Penney decorator, who was allowed to work from home, was covered by her Workers Comp policy when she tripped over her dog unloading a van.