The ISO Commercial General Liability Coverage Form can seem like a map that starts you out on a main road, takes you smack into a dead end, but offers you a right turn that you can take if you meet certain conditions. It begins with a broad promise and a hint that the promise isn’t quite that broad, then continues with a list of items that narrow that promise.

The ISO Commercial General Liability Coverage Form can seem like a map that starts you out on a main road, takes you smack into a dead end, but offers you a right turn that you can take if you meet certain conditions. It begins with a broad promise and a hint that the promise isn’t quite that broad, then continues with a list of items that narrow that promise.

However, some of those items contain a few words that actually make the promise a bit broader again. Somewhere in that twisting road lies the answer to whether the insurance will cover your business’s legal liability for an accident.

The form actually has three coverages, but the one most business owners are concerned with is Coverage A, Bodily Injury and Property Damage. The first part of Coverage A is the Insuring Agreement, which states that the insurance company will cover the insured person or organization’s legal liability for bodily injury or property damage to others. A key phrase, however, is that the company will pay amounts for occurrences “to which this insurance applies.” How do you know when the insurance applies? That’s where the list comes in.

Right after the Insuring Agreement is a section labeled Exclusions. This section begins with the sentence, “This insurance does not apply to: … ” and goes on to list 17 categories of occurrences. The insurance does not apply to any occurrences that fall within the meanings of those categories. The categories include things like pollution; injuries to the insured’s employees; ownership and use of motor vehicles, aircraft and watercraft; causing or contributing to a person’s intoxication; damage to property the insured owns or possesses; and loss of electronic data.

While these items narrow the insurance coverage considerably, some of them contain clauses that add a little coverage back in. For example, while the insurance does not apply to property damage arising from a contractor’s completed work, the exclusion gives back coverage if the property damage arose from work a subcontractor performed on the contractor’s behalf.

In a claim situation, different burdens of proof apply to either the insurance company or the insured organization, depending on what each one is claiming. The insured has the burden of proving that an accident falls within the Insuring Agreement. To do this, the insured must show that an “occurrence” that took place during the policy term caused bodily injury or property damage to someone else. If the insured cannot prove any one of these elements, the policy will not cover the loss.

The policy defines “occurrence” as “an accident, including continuous or repeated exposure to substantially the same general harmful conditions.” Therefore, the insured must prove that an accident (a piece of lumber falls and strikes another contractor’s employee on the back) occurred during the policy term and caused bodily injury or property damage.

Once the insured meets that burden, the insurance company now has the burden of proving that one of the exclusions applies. For example, it must prove that damage to an HVAC system the insured installed arose out of some defect in the system. If it cannot, then the insurance applies to the loss and the company must pay for the damage. If it can, then the burden shifts back to the insured to show that an exception to the exclusion applies.

If the insured can show that a subcontractor installed the defective components that malfunctioned and damaged the HVAC system, then the exception to the exclusion applies and the insurance company must pay the claim.

Contractors should work with insurance agents who are knowledgeable about the CGL policy and can answer complex coverage questions. This policy can provide millions of dollars in protection for a business, so it is important for the business owner to understand it.

In the event a disability that causes an inability to work occurs, Disability insurance works to replace a portion of your absent income. Although it should be obvious why Disability insurance is critical protection, many workers assume that they don’t need private Disability insurance since Social Security disability benefits are available. What many fail to understand is that eligibility for Social Security disability benefits hinges on the severity of the disability.

In the event a disability that causes an inability to work occurs, Disability insurance works to replace a portion of your absent income. Although it should be obvious why Disability insurance is critical protection, many workers assume that they don’t need private Disability insurance since Social Security disability benefits are available. What many fail to understand is that eligibility for Social Security disability benefits hinges on the severity of the disability. Your teen is ready to drive, and you have the privilege of preparing them for this responsibility. Use nine tips as you prep your teen to navigate the road safely.

Your teen is ready to drive, and you have the privilege of preparing them for this responsibility. Use nine tips as you prep your teen to navigate the road safely. Are you planning to welcome trick or treaters to your home this month? Follow 11 steps that prepare your property for safe Halloween fun.

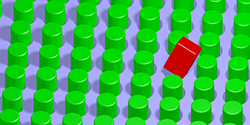

Are you planning to welcome trick or treaters to your home this month? Follow 11 steps that prepare your property for safe Halloween fun. I’m a big fan of using character assessment tools — and one of my favorites is www.zeroriskhr.com. My team and I are currently using their post-employment program to help improve our communication and make me a more effective boss. The folks at ZeroRisk reminded me that the employer’s goal is to match skills and natural abilities with job function. As the saying goes, “Put square pegs in square holes!”

I’m a big fan of using character assessment tools — and one of my favorites is www.zeroriskhr.com. My team and I are currently using their post-employment program to help improve our communication and make me a more effective boss. The folks at ZeroRisk reminded me that the employer’s goal is to match skills and natural abilities with job function. As the saying goes, “Put square pegs in square holes!” As a small business owner, you accept credit cards because it’s convenient for your customers and a smart business decision. You could be overpaying for your credit card processing privilege, though, which puts your business’s financial security at risk. Every month, evaluate your credit card processing statements and take six steps to avoid overpayment.

As a small business owner, you accept credit cards because it’s convenient for your customers and a smart business decision. You could be overpaying for your credit card processing privilege, though, which puts your business’s financial security at risk. Every month, evaluate your credit card processing statements and take six steps to avoid overpayment. Corrosives are solid or liquid substances that exact extreme caution when handling. They are usually either an acid, such as nitric acid, sulfuric acid, chromic acid, hydrochloric acid, hydrofluoric acid, or acetic acid, or a base, such as ammonium hydroxide, sodium hydroxide, or potassium hydroxide. Anyone that has ever seen the effects that corrosives have on metal or other strong materials can easily imagine the damage that a corrosive would do to the delicate human skin.

Corrosives are solid or liquid substances that exact extreme caution when handling. They are usually either an acid, such as nitric acid, sulfuric acid, chromic acid, hydrochloric acid, hydrofluoric acid, or acetic acid, or a base, such as ammonium hydroxide, sodium hydroxide, or potassium hydroxide. Anyone that has ever seen the effects that corrosives have on metal or other strong materials can easily imagine the damage that a corrosive would do to the delicate human skin. Your small business faces numerous risks every day. To protect your business, you need seven different insurance policies. Learn more about what they are and how they help you.

Your small business faces numerous risks every day. To protect your business, you need seven different insurance policies. Learn more about what they are and how they help you. When you’re searching for a job, every detail on your resume counts. Improve your chances of landing a great job when you use 10 resume tips that thrill hiring managers.

When you’re searching for a job, every detail on your resume counts. Improve your chances of landing a great job when you use 10 resume tips that thrill hiring managers.

Don’t wait until the weather forecast calls for prolonged heavy rains before buying flood insurance. While this practical insurance can be purchased anytime, the policy does not take effect for 30 days. As the most common natural disaster in the country, flooding ruins millions of dollars of homes and property every year. Even so, flooding is not commonly covered in your typical homeowner’s insurance policy, making it necessary to purchase additional coverage for this costly, devastating disaster.

Don’t wait until the weather forecast calls for prolonged heavy rains before buying flood insurance. While this practical insurance can be purchased anytime, the policy does not take effect for 30 days. As the most common natural disaster in the country, flooding ruins millions of dollars of homes and property every year. Even so, flooding is not commonly covered in your typical homeowner’s insurance policy, making it necessary to purchase additional coverage for this costly, devastating disaster.